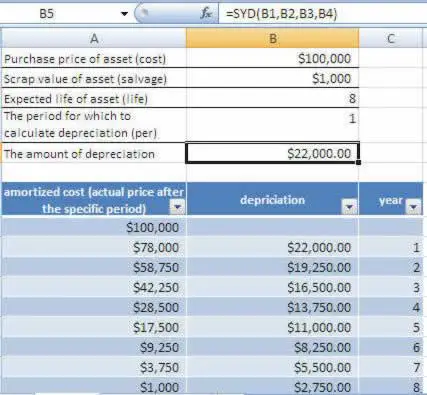

In this tutorial, we calculate the depreciation of an investment by using the SYD function, which returns the sum-of-years' digits depreciation of an asset for a specified period.

Syntex:

SYD(cost, salvage, life, per)

cost: The purchase price of the asset.

salvage: The scrap value of the asset. (The value of the asset at the end of the deprecation.)

life: The expected life of the asset (The number of periods over which the asset is depreciated.)

per: The period for which to calculate depreciation. (per must use the same units as life.)

- Enter the cost of purchase in cell B1.

- Enter the salvage value (scrap value) in cell B2.

- Enter in years the number of periods over which the purchase will be depreciated (product life) B3.

- Enter the value of period for which to calculate depreciation (per) in cell B4

- Calculate the depreciation in the fifth year in cell B5 with the following formula:

=SYD($B$1,$B$2,$B$3,$B$4) - Press Enter.

The above picture shows the purchase price of asset $100,000 and scrap value of the asset $1,000. And its also showing the amortized cost for each year (actual price after each period/year). You can see, after completing the asset life (which is 8 years) now its actual price is equal to scrap value ($1,000).